The owner of a popular Glasgow restaurant has taken to social media to lament the rejection of his application for grant assistance amid the Covid-19 coronavirus crisis, pointing out he has been denied because of a huge rise in the rateable value of the premises at the last revaluation.

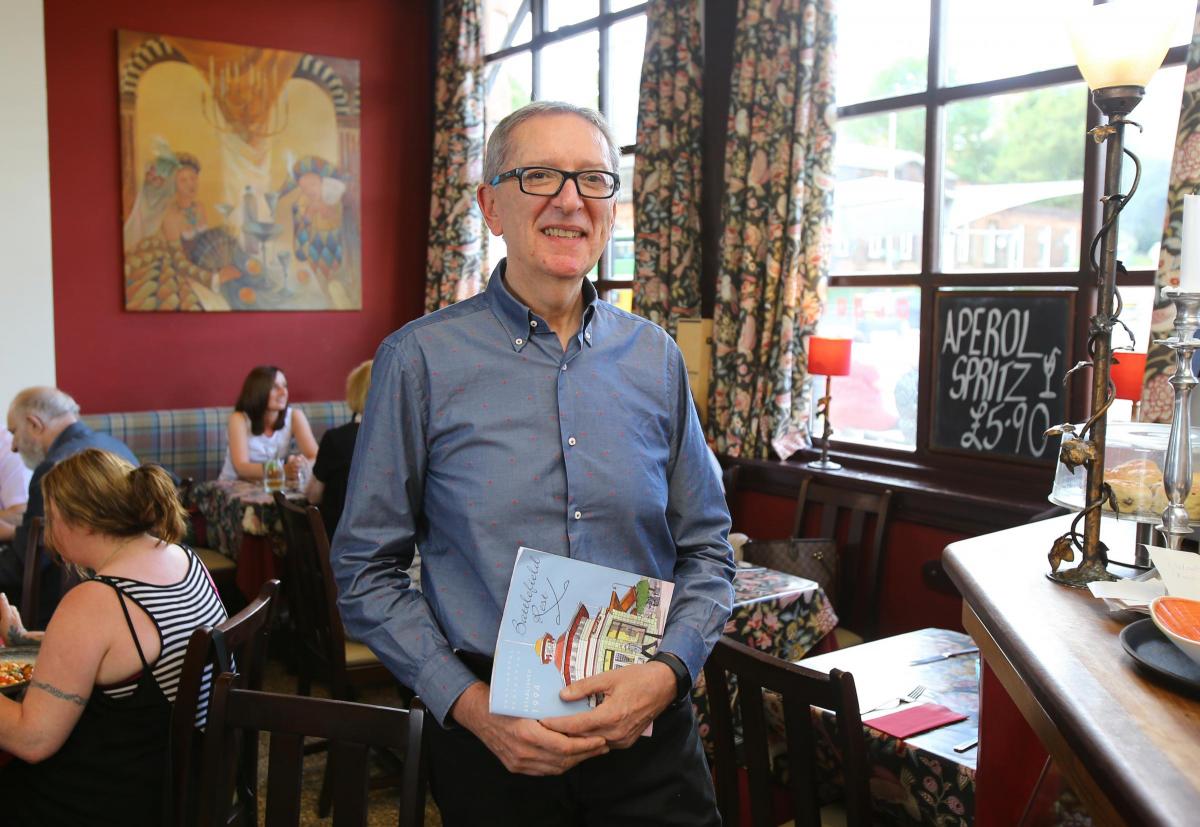

Marco Giannasi’s bid for grant funding for the renowned Battlefield Rest on the south side of Glasgow would, in terms of the restaurant’s previous rateable value, have been eligible in terms of the threshold set by the Scottish Government.

The restaurant owner protested the hike in rateable value at the time.

Mr Giannasi tweeted on Friday: “This morning I received the answer from my Grant application from the GCC (Glasgow City Council) and NO! Why? Because our business rates were increased by 411% on the last revaluation therefore not eligible because we are over the £51000 threshold.”

The Herald reported in March 2018 that more than 1,000 signatures had been secured in just four days by Mr Giannasi as he stepped up his campaign at that stage against a massive increase in his business rates bill.

Mr Giannasi, who has owned the Battlefield Rest for around a quarter of a century, said then that his bill for rates payable would rise by around 400% because of the most recent revaluation of non-domestic properties, which took place in 2017. It meant his annual bill would increase by £27,000 – if his current appeal bid to the local rates assessor was thrown out – he noted.

The rateable value of Mr Giannasi’s restaurant rose to £67,500 under the 2017 revaluation, up from £16,800 five years previously. He insisted in 2018 that there had been no major developments in the intervening period that could justify the increase.

Businesses with a rateable value of between £15,001 and £18,000 are entitled to rates relief of 25%.

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules hereLast Updated:

Report this comment Cancel